When the US yield curve inverted in 2022, the macro sentiment was “worsening.” This current inversion is notable because it has set a record for its duration. The 2-year and 10-year Treasury yields have been inverted since March 2022, marking the longest continuous yield curve inversion in U.S. history. However, the “macro mood” changed during 2023 and has been “improving” ever since. One way to nowcast this is by looking at the revisions of GDP forecasts.

GDP revisions have generally been positive, i.e., current estimates have been almost continuously revised upwards.

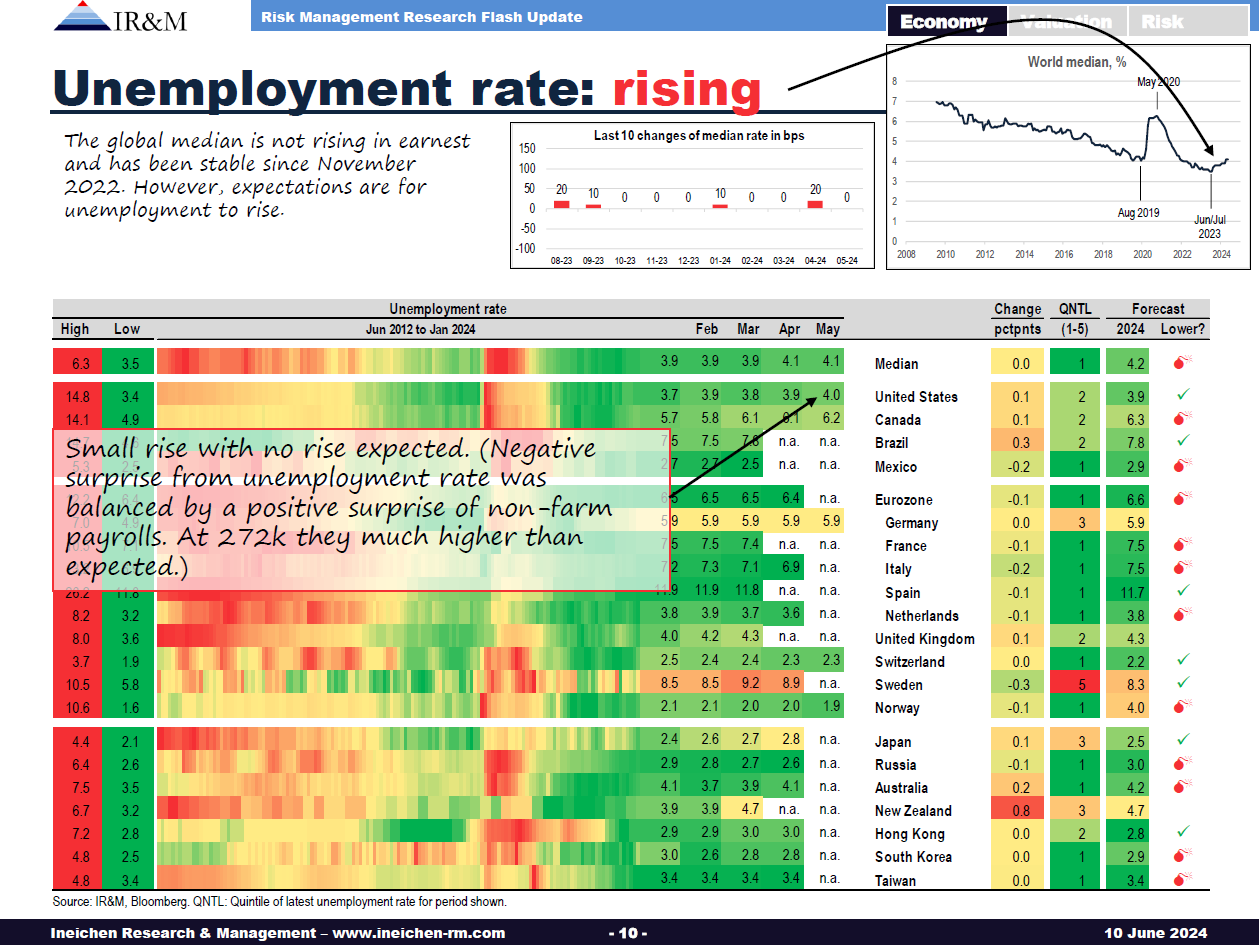

The average unemployment rate is rising, too, making things a bit more difficult. However, the unemployment rate is perceived as a lagging indicator.

Keep reading with a 7-day free trial

Subscribe to Alexander’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.