"Here’s the problem: ESG is trying to gauge the sensitivity of companies to the public mood, either for moral reasons or because the public matter as customers, suppliers and employees of the companies. But the public mood keeps changing, and what counted as the right thing to do before Russia invaded has suddenly switched."

—James Mackintosh, Senior Columnist, War in Ukraine Reveals Flaws in Sustainable Investing, WSJ, 27 March 2022 1

The Boston Consulting Group (BCG) Matrix has long been a staple for understanding product portfolio management. By classifying products into four categories—Stars, Cash Cows, Question Marks, and Dogs—the matrix allows businesses to allocate resources and assess growth potential. Products begin their lifecycle as Question Marks, move to Stars if successful, and can eventually become Cash Cows, generating steady profits with minimal investment. However, the matrix also reminds us that Cash Cows don't stay Cash Cows forever. As market dynamics shift, once-lucrative products can decline, even becoming Dogs. This is especially relevant in today’s investment landscape, where environmental, social, and governance (ESG) products have moved through their lifecycle. Once the trend had caught on, they became a Cash Cow for asset managers, index providers, and consultants. Yet, over the past 2-3 years, signs have emerged that interest in ESG has waned.

“ESG was a dotcom sort of hype 20 years later and now it has passed.”

—Pierre-Yves Gauthier, FT, 6 June 2024

In the early 2000s, ESG investing was very much a Question Mark in the BCG Matrix. Investors were curious about sustainability and ethical investing, but there was no clear consensus on whether these factors would translate into financial performance. At one level, ESG grew out of SRI (Sociably Responsible Investing), which had run its course by the early 2000s. It had become a Dog. As political activism on climate change and the stakeholder value idea grew, so did the interest in ESG-based investing.

"Reading annual reports of European companies is very frustrating. They spend 80% of the time on ESG bs, virtue signaling etc and not enough on the economics of the business."

—Vitaliy Katsenelson, @vitaliyk, X, 6 April 2022

Soon enough, ESG became a Star in the BCG Matrix—a high-growth product with immense potential. Asset management firms and index providers capitalized on this rising demand by launching ESG-focused funds, indexes, and consulting services. Aided by regulatory pushes, public demand, WEF propaganda, and a growing body of research suggesting ESG could enhance long-term returns, ESG products began broadly dominating the investment management scene. For a period, ESG was synonymous with growth. Firms like BlackRock and MSCI and countless consultants and service providers thrived on providing ESG services, which saw substantial fees attached.

“ESG is beyond redemption, testimony to the consequences of letting good intentions overwhelm good sense and allowing the selling imperative to define and drive mission. May it RIP.”

—Aswath Damodaran, FT, 26 October 2023

By the early 2020s, ESG investing had reached its zenith, evolving into a Cash Cow. The product had matured, gaining widespread adoption among institutional and private investors. At this stage, companies involved in ESG, from asset managers to index providers, enjoyed steady, high-margin returns. ESG funds attracted vast sums of capital, ESG ratings were a staple in investment decision-making, and firms saw ESG as an essential part of their business strategy.

“The notion that adding an ESG constraint to investing increases expected returns is counter intuitive. After all, a constrained optimum can, at best, match an unconstrained one, and most of the time, the constraint will create a cost.”

—Aswath Damodaran (b. 1957), India-born professor of finance2

However, just as the BCG Matrix suggests, no Cash Cow remains a Cash Cow indefinitely. Market conditions change, consumer interests evolve, and new factors can disrupt the status quo. In recent years, there have been signs that ESG’s Cash Cow heyday is over ending.

First, the backlash against so-called “greenwashing”—the superficial application of ESG principles—has grown. Many investors have become disillusioned by companies that promote ESG practices without meaningful impact. Moreover, questions about the consistency and reliability of ESG ratings have surfaced, with critics pointing out the lack of standardization across providers. This has led to scepticism regarding the true value of ESG-focused funds.

"I don't see how one can effectively legislate morality or ethics."

—Alan Greenspan (b. 1926), American economist and Ayn Rand’s buddy3

Second, the regulatory environment has become more complex. While initially favourable, regulators are now scrutinizing ESG claims more closely, leading to legal challenges and additional compliance costs. For instance, in the United States, the Securities and Exchange Commission (SEC) has been investigating ESG funds for misleading claims, and Europe has imposed stringent ESG-related disclosure requirements. These added burdens have weighed on profitability.

Third, the market’s interest is shifting toward new investment themes. While sustainability and corporate responsibility are still important, topics like artificial intelligence (AI), digital transformation, data centres, and obesity drugs are now capturing the spotlight. Investors, always looking for the next Star in the BCG Matrix, are reallocating capital from ESG to these emerging areas, reducing the cash inflow into ESG funds.

"ESG has become weaponised by liberal activists to push forward their harmful, social-Marxist agenda."

—Robert Netzly, CEO of Inspire, FT, 1 September 2022 4

Fourth, it has become increasingly apparent that ESG is a weaponised tool for Agenda 2030. ESG has always been part of Agenda 2030, and the UN/WEF has been quite transparent about it. However, the perception has changed over the past couple of years. Initially, the road was paved with good intentions. As these roads often are.

“In adopting the multi-stakeholder model, the corporate managerial class has pulled off the perfect con: CEOs can do whatever they want so long as they say they have everyone’s best interests in mind. Wokenomics is a powerful weapon for CEOs, which they can readily deploy as a smoke screen to distract from greed, fraud, and malfeasance. It provides the perfect alibi: accountability to everyone is accountability to no one at all.”

—Vivek Ramaswamy (b. 1985), American biotech entrepreneur and author5

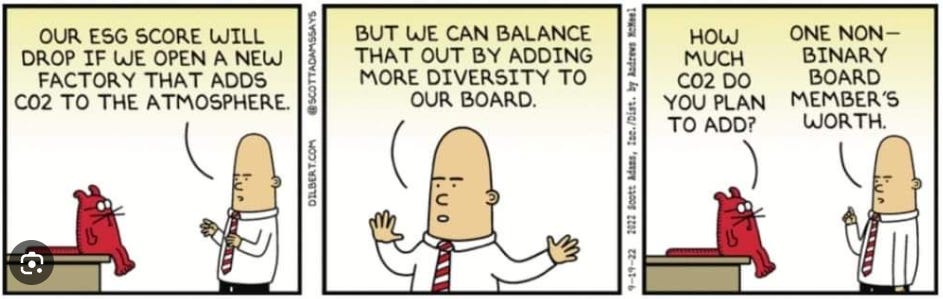

Fifth, there is a link between wokeism and ESG, and wokeism has become much more radical and both reason and reality-deficient over the past years. It started with good intentions about increasing tolerance for minorities. Today, wokeism is bellowed mainly by antisemitic, obesity-promoting, reverse-racist, police-defunding, sexually deviant, paraphilia-promoting, art-destroying, intellectually post-modern, book-burning, terrorist-appeasing, history-ignorant, biology-confused, climate-crazy zealots. This has become a movement that most investors, understandably, to this author, do not want to have any association with. (Whether peak-wokeism is when a diversity hire with neither political acumen nor leadership qualifications becomes the new leader of the free world in November of this year is, at the time of writing, unknown.)

“ESG was born in a bullish environment and now we are in the opposite. The cost of capital is going up and many green things are inflationary.”

—”top sustainability banker,” FT, 5 December 2023

Lastly, global macroeconomic pressures during 2022, including inflation, rising interest rates, and geopolitical tensions, have caused a shift toward more traditional, value-oriented investment strategies. In times of uncertainty, investors tend to prioritize short-term gains over long-term, uncertain returns, leading to a decline in enthusiasm for ESG.

“One prominent bond fund manager argues that it ‘makes no sense’ to try to impose one universal do-gooder framework on all clients because each of them holds different values. His prediction? ‘ESG will be dead in five years.’”

—FT, 5 December 2023

While ESG may no longer be the Cash Cow it once was, this doesn’t mean it’s headed straight into the Dog category. However, ESG’s rapid growth and hype phase has ended. Peak-ESG was probably around 2021. The product is maturing, and companies in the ESG space will need to adapt to these changing dynamics if they wish to maintain profitability.

For asset managers, this may mean integrating ESG more seamlessly into broader investment strategies rather than promoting it as a standalone product. For index providers and consultants, the next challenge will be to refine ESG metrics, improve transparency, and rebuild trust among investors. In doing so, ESG may continue to play a vital role in portfolios, albeit without the outsized profits and hype it once generated. In some jurisdictions, however, it is being outlawed, as it violates the Prudent Investor Rule (formerly known as the Prudent Man Rule) and, in some places, is perceived as a misallocation of capital. The misuse of ESG for political Agenda 2030 reasons is not for everyone. In 2022, I wrote:

"'ESG investing' in its current form is similar to people who take selfies of themselves in fancy locations to show they were there, while barely experiencing it for real.

Mostly theatre, little substance."

—Lyn Alden, @LynAldenContact, X, 17 January 2022

In conclusion, ESG’s journey through the BCG Matrix highlights a critical lesson in product lifecycle management: no product, no matter how successful, remains at the top forever. Asset managers, index providers, and consultants who profited greatly from ESG must now navigate a more competitive, sceptical market.

Trivia:

“Dad, why isn’t China concerned about climate change, Agenda 2030 and ESG.”

“Because they already have a communist government, son.”

I commented at the time (IR&M Flash Update, 4 April 2022): “The war made the flaws of ESG more apparent. ESG is partially responsible for the underinvestment in fossil energy and subsequent price rises. ESG is also partially responsible for the energy import dependency as it is averse to nuclear energy/uranium mining and fracking, that is local. This begs the question whether ESG has peaked and will now slowly disappear, as did its predecessor SRI twenty years ago.”

https://aswathdamodaran.blogspot.com/2020/09/sounding-good-or-doing-good-skeptical.html

Testimony of Chairman Alan Greenspan Federal Reserve Board's semiannual monetary policy report to the Congress Before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate July 16, 2002.

I commented at the time: “The operational word in the quote is "harmful". Inspire Investing, an ETF provider, said in an article on its website that it had decided to renounce ESG because “hard-left activists were seeking to strong-arm companies into acquiescence with their extremist policies” on ESG issues. The harm conducted by degrowth ideology is becoming more apparent. To be filed under litigation risk.”

Vivek Ramaswamy, Woke, Inc.: Inside corporate America's social justice scam (New York, NY: Center Street, 2021), chap. 4, Kindle.