“No risk.”

—Tim Geithner (b. 1961), American politician. Response to the question whether the US could lose its AAA credit rating, three months prior to downgrade to AA+.1

“No risk” is a stupid thing to say. There is always risk. Additionally, there is always uncertainty. In finance, the distinction between risk and uncertainty was famously articulated by economist Frank Knight in his 1921 work Risk, Uncertainty, and Profit. Knight defined risk as situations where the probability distribution of outcomes is known or can be estimated, such as the likelihood of default on a bond or the volatility of a stock. These risks can be priced, insured against, and incorporated into models. Uncertainty, by contrast, refers to situations where outcomes cannot be quantified with probabilities because the future is fundamentally unknowable, such as disruptive technological change, political upheaval, or being vaporised by Vogons.

“Risk, to state the obvious, is inherent in all business and financial activity.”

—Alan Greenspan (b. 1926), American economist and former Chairman of the Fed2

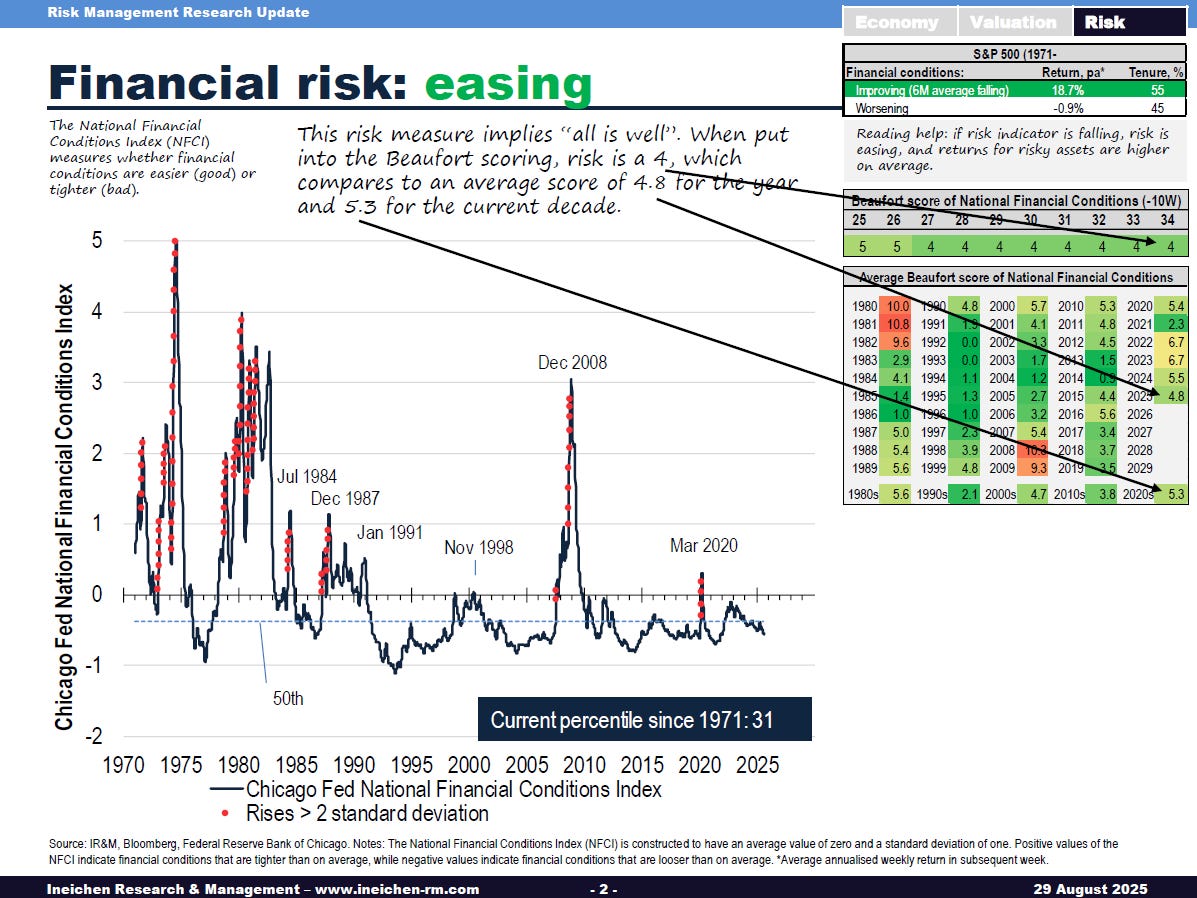

One way to measure risk is with, well, risk measures. There is no such thing as return management. The entire industry revolves around risk management. That’s good news in the sense that there is an element of measurement. Risk, up to a point, can be measured. Additionally, we can measure the change. I do this for a living. I take an imperfect measure of risk and then measure how it changed. The measurement, the risk indicator, will be flawed or imperfect, but the change itself is objective. Some analysts even try to measure the risk of tyranny. (One attempt to assess tyranny risk is to elaborate where an economy stands on the Road-to-Serfdom-1984 continuum.) Here is an example for measuring financial risk as of last Friday:

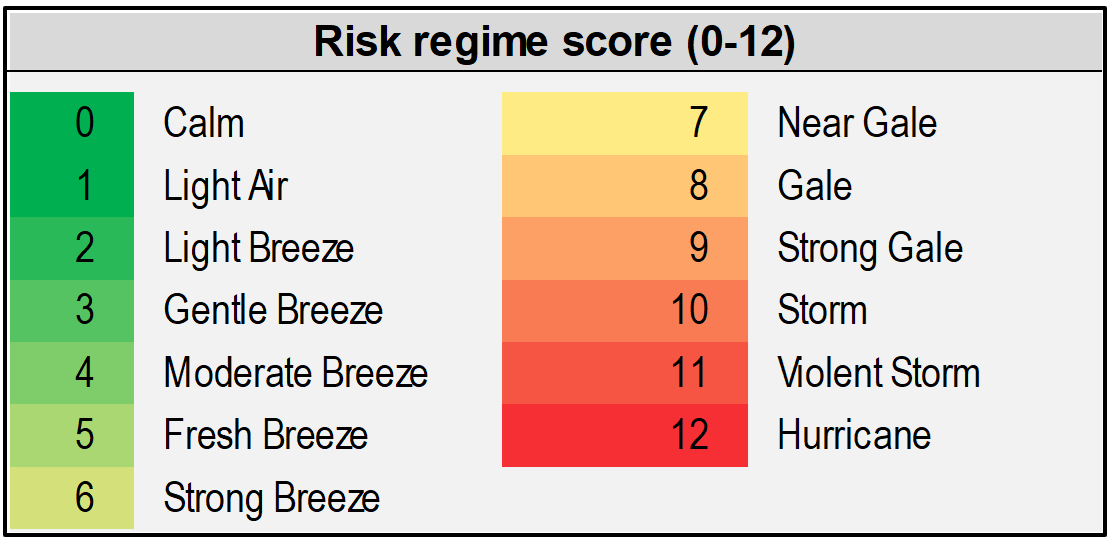

Over the past 2-3 years, I have translated risk measures into the 0-12 Beaufort wind scale. (I used to windsurf as a teenager, and my experience with a 10 on the Beaufort score wasn’t pleasant.)

One of the takeaways of the financial risk chart above is that “we” are in a risk regime of 4 on the Beaufort-inspired risk score. This is akin to a “moderate breeze,” even if it doesn’t feel like a “moderate breeze” when reading the daily newspapers.

Another takeaway of the chart is that now is different from large parts of the 1990s, where the risk regime was closer to “calm” or a “light breeze”.

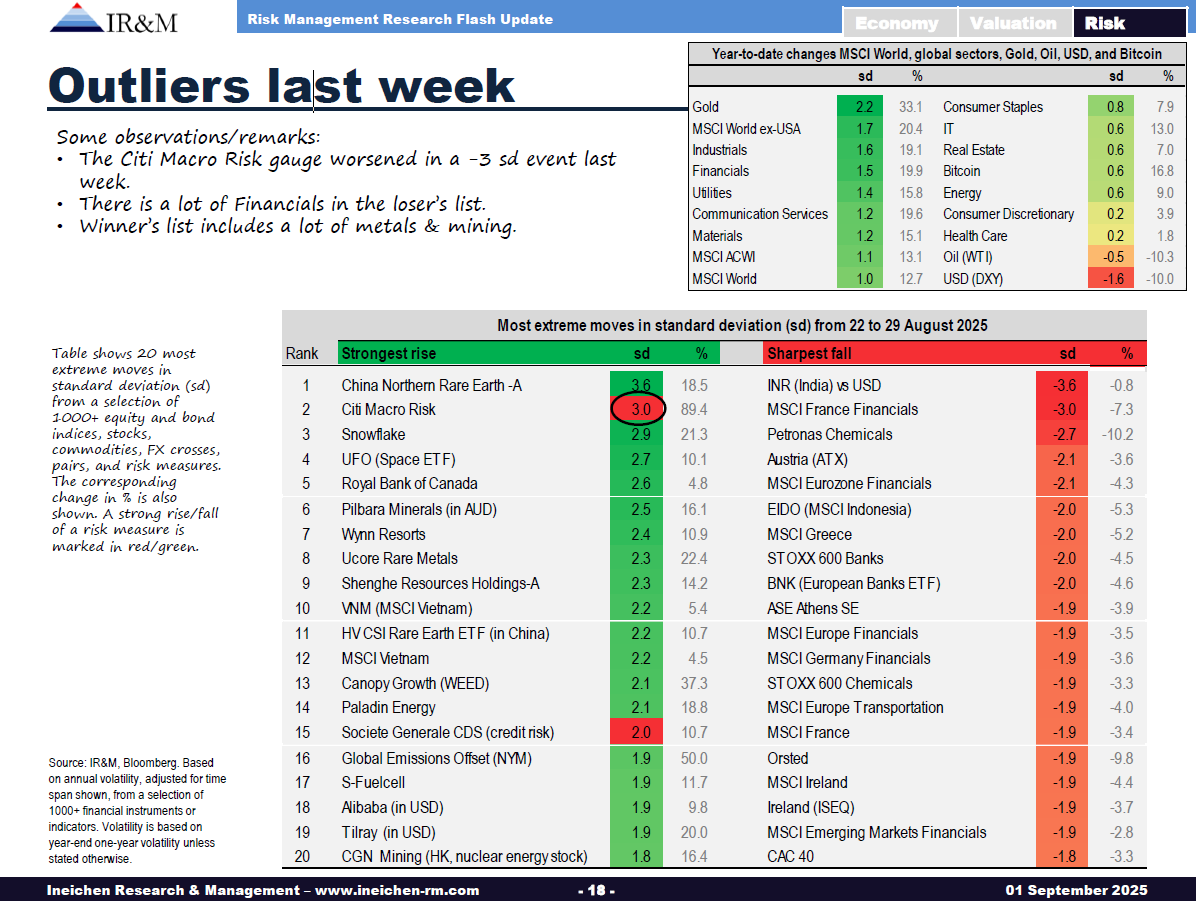

The key aspect, though, is change. The situation is “fine” when measures such as the one shown here are “easing,” i.e., risk is dissipating. Red flags pop up when the risk measures start to rise. A particular focus is when risk measures gap, i.e., when the magnitude of the change is extraordinary. Like for example in Financials last week:

While the financial risk measure shown above implies investment bliss, not all is well:

Keep reading with a 7-day free trial

Subscribe to Alexander’s Newsletter to keep reading this post and get 7 days of free access to the full post archives.