“Stupid is who stupid does.”

—Forrest Gump

Nassim Taleb coined the term “antifragile”. It was a new word in the English language and a new concept. It’s the opposite of fragile. If something is sensitive to stress, it is fragile. Like a Ming vase. Drop it, and it’s broken. Antifragile is the opposite. It benefits from stress. Like Switzerland.

“In life, antifragility is reached by not being a sucker.”

—Nassim Nicholas Taleb (b. 1960), Lebanese-American risk analyst and author1

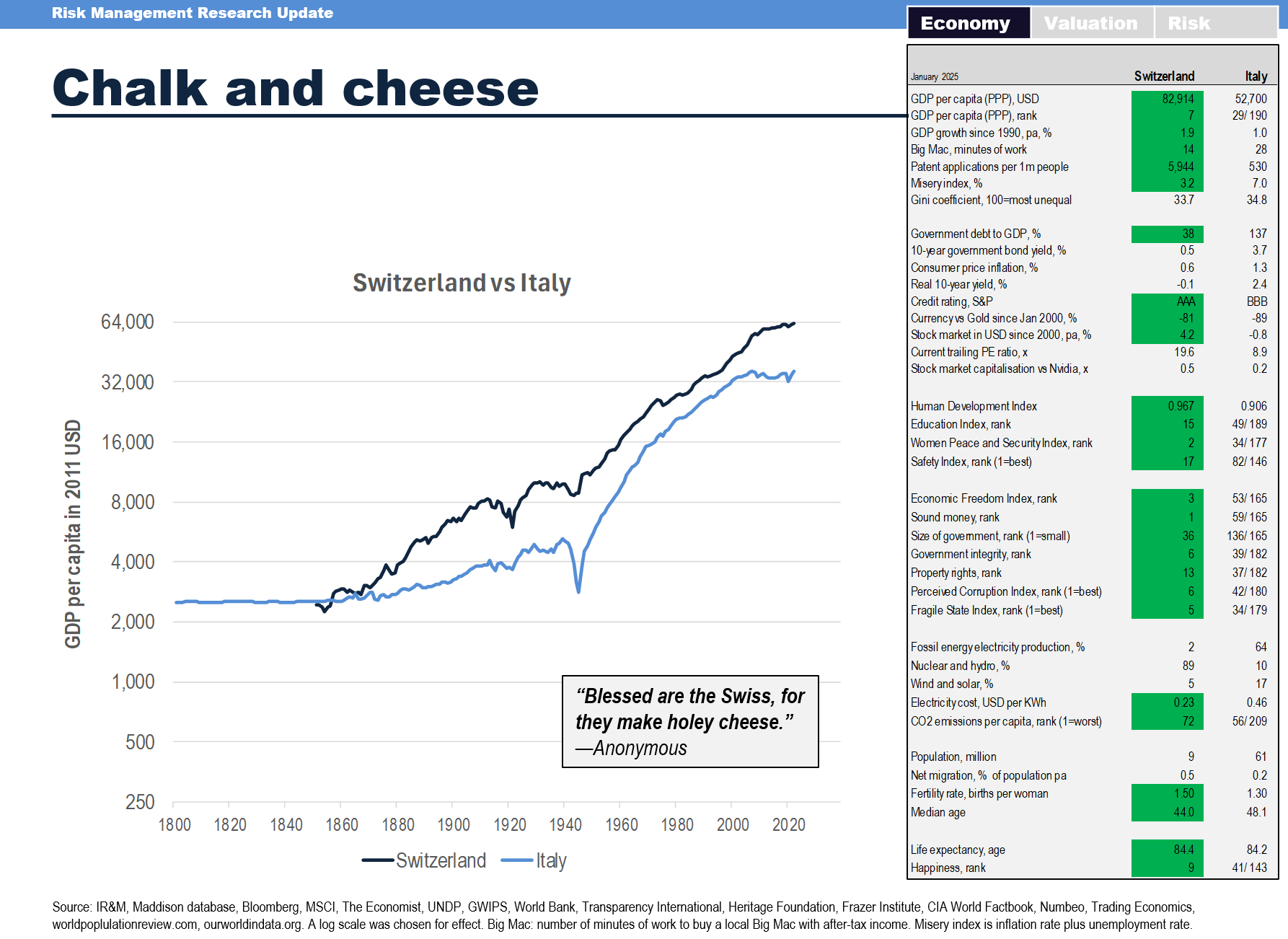

In Antifragile, Taleb mentions Switzerland as an example of a system that benefits from decentralization and a lack of over-planning. He argues that the country's political and economic stability stems from its fragmented, decentralized governance structure and its avoidance of large-scale interventions or centralized power. Taleb highlights that Switzerland thrives by being robust and antifragile in certain respects, such as its financial systems and its ability to adapt to external shocks. (Taleb also acknowledges that Switzerland benefits only to a certain extent, implying that there are limits to its antifragility.)

“The world has been governed too long by folly and ignorance; and such a government will continue until it shall be resisted with courage and reason."

—Thomas Paine (1736 - 1809), English-born American political activist, philosopher, political theorist, and revolutionary2

The opposite of stupid is generally considered to be intelligent or smart. But here’s a question: is there a word for an entity benefitting from another entity’s stupidity? Antistupid as an adjective, for example, or stupigainer as a noun. Or is the beneficiary a stupitee and the actual benefit is an idiofit? A country full of retards, according to HBO, is called an idiocracy. And what about the connotation of the stupiteeing? Is it positive or negative? The Swiss perspective from antifragility is positive, but the positivity is not shared universally. Switzerland, every now and then, is considered a free-rider or, worse, a parasite. The Swiss perspective on the matter is that you cannot blame the fox for the wokeness weakness—or stupidity—of the lamb. But there are ethical considerations in the matter.

“Human stupidity is one of the most important forces in history, yet we often discount it.”

—Yuval Noah Harari (b. 1976), Israeli historian and author3

Switzerland, the land of pristine lakes, towering mountains, enviable neutrality, and handsome independent financial analysts, is often regarded as an anomaly in the global landscape. Its unique position as a small, decentralized country with immense wealth is not merely a product of its own doing but, arguably, a testament to the stupidity of others. As left-wing governments and authoritarian regimes around the world impose draconian taxes, stifle innovation, and drive out their most talented and affluent citizens, Switzerland quietly reaps the rewards. The wealth exodus from dysfunctional governance elsewhere flows into Swiss banks, real estate, and local economies, solidifying its position as a haven for freedom and prosperity. Switzerland, as well as the US, Singapore, Dubai, Israel, Ireland, Luxembourg, and others, are beneficiaries of the exodus of the Five Bs (bucks, businesses, brains, bodies, and blueprints.) They are stupitees, so to speak, beneficiaries of idiocratic government elsewhere.

“Some people get rich studying artificial intelligence. Me, I make money studying natural stupidity.”

—Carl Icahn (b. 1936), American investor4

Left-wing governments, in their pursuit of "equity" and redistribution, often overreach with punitive taxes and rigid regulations. Wealth creators—entrepreneurs, investors, and professionals—find themselves burdened by policies that punish success rather than foster it. Similarly, authoritarian regimes—whether through corruption, lack of property rights, ideology, egomania, ill will, wickedness, or stifling central control—create environments where financial and personal security are perpetually under threat. These systems push the world’s wealthiest and most capable individuals to seek refuge elsewhere. They take their belongings with them. The Five Bs are mobile:

“Capital will always go where it’s welcome and stay where it’s well treated… Capital is not just money. It’s also talent and ideas. They, too, will go where they’re welcome and stay where they are well treated.”

—Walter Bigelow Wriston (1919-2005), banker and former chairman of Citibank5

Switzerland, with its low taxes, stable institutions, high government integrity, low crime, low misery index, high quality of living, and respect for personal freedoms, has become an obvious choice. Wealthy individuals from France, Germany, Italy, and even further afield relocate their assets, businesses, and sometimes their entire families to Switzerland. The stupidity of others—be it through ideological rigidity or authoritarian incompetence—creates a golden opportunity for the Swiss to attract capital and talent. The United States is also a stupitee, as, until quite recently, was London and the UK.

“Switzerland is the perfect opposite to the EU’s crumbling model.”

—Allister Heath (b. 1978), British business journalist and commentator6

Switzerland’s decentralized governance structure—divided into cantons—makes it inherently robust and adaptable. It avoids the pitfalls of over-centralized systems where one-size-fits-all policies can wreak havoc. Each canton competes to offer the most attractive tax rates and business environments, creating a race to the top rather than a race to mediocrity. Unlike large bureaucratic states that stifle local innovation, Switzerland’s system rewards efficiency and responsiveness. Switzerland is to the EU what Bitcoin is to MMT. The former fosters decentralisation and freedom, and the latter centralised planning and control.

The antifragile structure enables Switzerland to thrive in the chaos created by others. When high-tax countries self-mutilate and drive out their wealth creators, the likes of Switzerland step in to provide stability and discretion. When authoritarian regimes confiscate wealth or suppress freedoms, freedom-huggers offer an alternative—a place where private property and individual rights are sacrosanct. Switzerland is not alone in this regard. This begs the question of whether one should stop slicing countries into “right” and “left” but, instead, into “smart” and “stupid”. As, for example, did the WSJ in 2019:

“World’s Dumbest Energy Policy - After giving up nuclear power, Germany now wants to abandon coal.”

—Article title, WSJ, 29 January 2019.

According to this line of thinking, economic and societal self-mutilation and ousting the Five Bs is stupid. The exodus of the Five Bs and wealth immigration are but two sides of the same coin. Wealth immigration is not just about individuals bringing money into another country; it’s about the long-term benefits that come with it. Wealthy, smart, skilled, savvy, and business-ambitious immigrants contribute to the local economy by purchasing real estate, hiring local staff, setting up businesses, and investing in local businesses. They also bring with them their patents and a network of global connections, further enhancing the stupitee’s role as a hub for finance, entrepreneurism, and innovation.

Moreover, wealth immigration helps diversify a stupitee’s economy. Savvy immigrants often act as catalysts for new business ventures, creating jobs and opportunities for the stupitee’s citizens. The exodus of the Five Bs weakens the stupiter and strengthens the stupitee.

A joke that circulated in Switzerland a couple of years ago when interest rates were negative was that the Swiss government should issue a 100-year bond with a coupon of 0%. The bond could have been issued at par and paid back at par in 100 years. It would have been opportunistic, a bit cheeky, and, arguably, an example of stupiteeing.

Critics argue that Switzerland’s role as a tax haven and refuge for global wealth is exploitative, undermining efforts to achieve global equity. However, this perspective overlooks a fundamental truth: wealth is not created by governments but by individuals. When governments stifle that creation through incompetence or coercion, the blame lies not with Switzerland but with the systems that drive wealth away in the first place. The Swiss, as my wife attests at every opportunity that arises, are not smarter than anyone else, but, still, the Swiss are stupitees:

“It is the fundamental wisdom of the capitalist system that it functions irrespective of the wisdom or the stupidity of the capitalists.”

—Gustav Stolper (1888-1947), Austria-Hungary born German economist and politician7

By providing a sanctuary for those fleeing economic oppression and tyranny, Switzerland upholds the values of freedom and meritocracy. It proves that a society can prosper by respecting individual rights and fostering an environment where success is celebrated, not penalized.

"Stupid is who stupid does" aptly summarizes the dynamic at play. Governments that act stupidly—whether through overreach, inefficiency, ideology, or authoritarianism—sow the seeds of their own decline. Governments that avoid stupidity, by contrast, reap the benefits of avoiding folly: wealth immigration, societal stability and economic affluence. As long as idiocrats continue to drive away the Five Bs, there will be stupitees who will stand ready to benefit—quietly and efficiently. (Texas benefited hugely from Canada being run by an idiocrat for so long.) The Five Bs are a prerequisite for the Five Cs (cash, car, credit card, condominium, and country club membership).

Misquoting Ayn Rand: You can avoid stupidity, but you cannot avoid the consequences of stupidity.8

Trivia:

Nassim Taleb, Antifragile - Things that Gain from Disorder, 2012. Emphasis in the original.

Thomas Paine, The Rights of Man, 1791.

Yuval Noah Harari, 21 Lessons for the 21st Century, 2018.

Twitter profile of @Carl_C_Icahn, retrieved 29 January 2019.

Rich Karlgaard, “Predicting the Future: Part II,” Forbes, 13 February 2006:

“Another modern law was best described by banking legend Walter Wriston, a great thinker who died a year ago. Let's call it Wriston's Law of Capital. In the age of electronic money transfers, said Wriston, "Capital will always go where it's welcome and stay where it's well treated." Capital is mobile, capital is in play, and if you want some of it, you'd better treat it well. Evidently the state of Maryland hasn't heard of Wriston's Law. It recently passed laws raising the minimum wage and requiring large employers such as Wal-Mart to pay higher employee health care insurance costs. Wriston's Law predicts that these decisions will be good for the economy … neighboring Virginia's economy.

Wriston once told me that capital is not just money, "It's also talent and ideas. They, too, will go where they're welcome and stay where they're well treated." Google understands Wriston's Law perfectly. The company attracts the first cut of talent in Silicon Valley because it offers stock options, the value of which has risen. But more than that, Google gives creative freedom to its scientists and engineers. One day a week the brainiacs work on whatever projects they like. Google is a giant playpen. This is Wriston's Law at work.”

Brexit: The Movie, 2016.

Gustav Stolper, This Age of Fables, 1942.

“You can avoid reality, but you cannot avoid the consequences of avoiding reality.” Ayn Rand.

This quote is a variant or a derivative from a 1961 speech Ayn Rand gave at a symposium titled “Ethics in Our Time” held at the University of Wisconsin in Madison. The original reads as follows: "He is free to make the wrong choice, but not free to succeed with it. He is free to evade reality, he is free to unfocus his mind and stumble blindly down any road he pleases, but not free to avoid the abyss he refuses to see. Knowledge, for any conscious organism, is the means of survival; to a living consciousness, every “is” implies an “ought.” Man is free to choose not to be conscious, but not free to escape the penalty of unconsciousness: destruction." From quoteinvestigator.com, 15 May 2017. Sometimes the quote I use is paraphrased as "You can ignore reality, but you cannot ignore the consequences of ignoring reality." This is from her interestingly titled book The Virtue of Selfishness (1964). Full quote: "Neither life nor happiness can be achieved by the pursuit of irrational whims. Just as man is free to attempt to survive by any random means, as a parasite, a moocher or a looter, but not free to succeed at it beyond the range of the moment—so he is free to seek his happiness in any irrational fraud, any whim, any delusion, any mindless escape from reality, but not free to succeed at it beyond the range of the moment nor to escape the consequences." From wikiquote.org, 15 May 2017.