The Five Bs, 3/5

Bucks, Singapore, ESG, and government-subsidised Veblen products

“I’d rather cry in a Rolls-Royce than on a bicycle.”

—Zhao Wei (b. 1976), Chinese actress

Bucks, Singapore, ESG, and government-subsidised Veblen products

Bucks, slang for money, capital, and investment, are the lifeblood of any thriving economy. Without the free movement of capital and the ability to invest where it yields the highest returns, economies stagnate, innovation dries up, and productivity collapses. History has shown that nations which embrace capital accumulation, sound financial institutions, and an investment-friendly climate experience prosperity, while those that restrict capital flow fall into mediocrity or, worse, decline.

Singapore serves as a shining beacon of how capital attraction can transform a small island nation into an economic powerhouse. Meanwhile, Dubai has successfully modelled itself after Singapore’s playbook, proving that well-structured financial policies can turn deserts into global hubs of commerce. However, there are ideological roadblocks—such as collectivism and ESG-driven distortions—that misallocate capital and inhibit wealth creation.

“Friedrich Hayek's book The Fatal Conceit: Errors of Socialism expressed with clarity and authority what I had long felt but was unable to express, namely the unwisdom of powerful intellects, including Albert Einstein, when they believed that a powerful brain can devise a better system and bring about more "social justice" than what historical evolution, or economic Darwinism, has been able to work out over the centuries.”

—Lee Kuan Yew (1923-2015), Founding Father and Prime Minister of Singapore1

Singapore’s meteoric rise from a Third World backwater in the 1960s to one of the world’s wealthiest nations is a testament to the power of sound financial policies. When Lee Kuan Yew took charge, he understood that wealth is not created through redistribution but through investment, innovation, and trade. His government built a pro-business environment with low taxes, minimal regulation, and a world-class financial system. For this reason, Singapore is sometimes referred to as the Switzerland of Asia. Interestingly, in more recent times, given the success of Singapore, Switzerland has been referred to as the Singapore of Europe.

By removing barriers to capital inflows and ensuring investor confidence, Singapore became an international financial hub, attracting banks, multinational corporations, and entrepreneurs. Today, the country boasts one of the highest GDP per capita figures in the world, proving that economic success follows when capital flows freely to productive enterprises rather than being squandered on wasteful government programs.

“I learned to ignore criticism and advice from experts and quasi-experts, especially academics in the social and political sciences. They have pet theories on how a society should develop to approximate their ideal, especially how poverty should be reduced and welfare extended. I always try to be correct, not politically correct.”

—Lee Kuan Yew2

Dubai, once a sleepy fishing village, has followed Singapore’s model by positioning itself as a business-friendly environment. With no personal income tax, free trade zones, and an openness to foreign investment, Dubai transformed itself into a global financial hub. While the oil wealth provided a temporary boost, wise financial policies sustained the emirate’s rapid growth.

“Capital never cares whether you're black, white, Communist, socialist, Christian, or Muslim. All it cares about is its safety and its profit. It goes where the opportunities are.“

—Jim Rogers (b. 1942), American investor and Singapore fan3

Like Singapore, Dubai understood that bucks are cowardly. Bucks flee high taxation, excessive regulation, and government mismanagement. Instead, by ensuring a stable, investor-friendly environment, Dubai attracts bucks, businesses, talent, and investment from around the world. Both Singapore and Dubai do the Five Bs right.

“The whole gospel of Karl Marx can be summed up in a single sentence: Hate the man who is better off than you are. Never under any circumstances admit that his success may be due to his own efforts, to the productive contribution he has made to the whole community. Always attribute his success to the exploitation, the cheating, the more or less open robbery of others. Never under any circumstances admit that your own failure may be owing to your own weakness, or that the failure of anyone else may be due to his own defects... to his laziness, incompetence, improvidence or simple stupidity.”

—Henry Hazlitt (1894-1993), American journalist4

While Singapore and Dubai are examples of the benefits of free capital markets, collectivist economies like the Soviet Union, Maoist China, and present-day Venezuela demonstrate the perils of capital misallocation. Collectivist ideologies assume that wealth can be centrally planned and redistributed effectively, but history proves otherwise.

“I wish Karl would accumulate some capital, instead of just writing about it.”

—Mother of Karl Marx5

Karl Marx, who wrote Das Kapital without ever having earned a cent in the real economy, fundamentally misunderstood how wealth is created. He believed capital was an exploitative tool of the bourgeoisie rather than a necessary instrument for economic growth. Thomas Piketty, his modern disciple, continues this tradition of ignorance by attempting to justify punitive wealth taxes that would only discourage investment and innovation.

Collectivist policies invariably lead to economic dysfunction because they allocate capital based on ideology or political motivations rather than market efficiency. Resources flow toward unproductive government projects rather than innovative businesses, resulting in stagnation, unemployment, and, ultimately, economic collapse.

“Idealism is fine, but as it approaches reality, the costs become prohibitive.”

—William F. Buckley Jr. (1925-2008), American author6

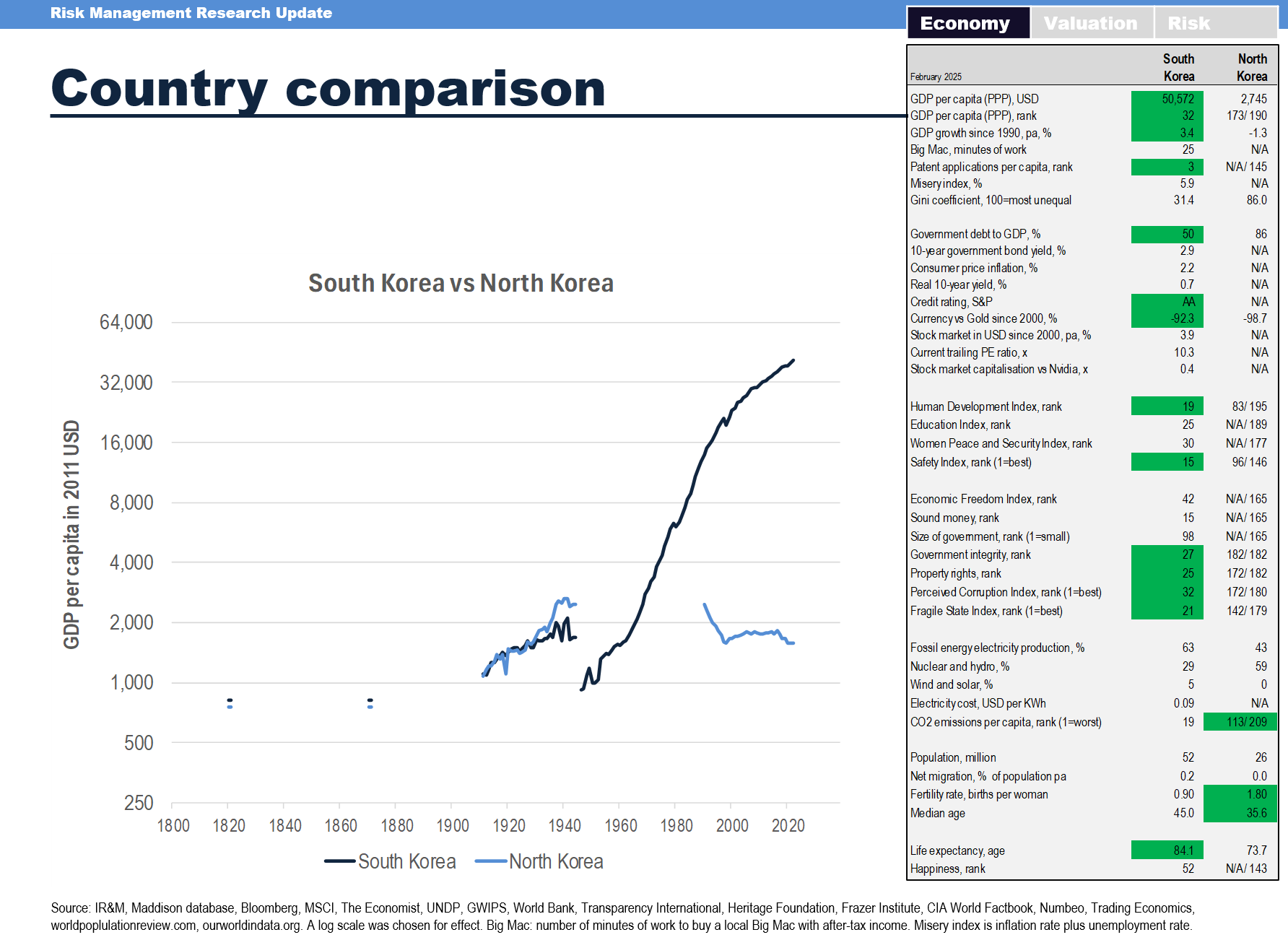

Currently, there is a live experiment going on:

Eight centimetres is the result of getting the Five Bs wrong. The average capitalist in the South of Korea is around 173 cm tall, while the average communist in the North is around 165 cm. One hundred years ago, it was one country with the same food supplies, the same GDP per capita, happiness, safety, etc. No more.

“In adopting the multi-stakeholder model, the corporate managerial class has pulled off the perfect con: CEOs can do whatever they want so long as they say they have everyone’s best interests in mind. Wokenomics is a powerful weapon for CEOs, which they can readily deploy as a smoke screen to distract from greed, fraud, and malfeasance. It provides the perfect alibi: accountability to everyone is accountability to no one at all.”

—Vivek Ramaswamy (b. 1985), American biotech entrepreneur and author7

Environmental, Social, and Governance (ESG) investing has emerged as another ideological distortion of the Five Bs, mainly the allocation of bucks/capital. Under ESG frameworks, investments are not directed toward their most productive use but instead funnelled into politically favoured causes, often at the expense of economic merit. The World Economic Forum (WEF), whose founder has been promoting the stakeholder-value idea since publishing the Davos Manifesto in 1973, is perhaps the most prominent ESG cheerleader, consistently emphasising the importance of ESG criteria as tools to address climate risk. Below is a comparison between WEF-supported energy and Trump-supported energy:

“German wind is about as reliable as British trains… A better word for renewables is unrealiables.”

—Paul Marshall, ARC conference, London, 17 February 2025

ESG mandates weaken businesses, increase costs, and create artificial market distortions by prioritizing virtue-signaling over profitability. Instead of allowing investors to allocate capital based on merit, ESG forces money into sectors that may be less efficient, reducing overall wealth creation. The irony is that ESG proponents claim to be acting for the “greater good,” yet their policies inevitably lead to economic inefficiency and declining prosperity. If stupidity is a risk, as Hazlitt pointed out earlier, so is ESG:

“As someone who lived under communism for most of his life, I feel obliged to say that I see the biggest threat to freedom, democracy, the market economy and prosperity now in ambitious environmentalism, not in communism. This ideology wants to replace the free and spontaneous evolution of mankind by a sort of central (now global) planning.”

—Václav Klaus (b. 1941), Czech economist, politician, and PM8

ESG favours renewables over cheap and reliable energy. To some extent, renewables show some similarities to Veblen products. Many renewable energy solutions, particularly in their current inefficient forms, do not solve climate problems but instead serve as status symbols for the anointed. This makes them an example of Veblen products—goods that become more desirable as their price increases because they confer prestige rather than practical utility:

Thorstein Veblen, an economist known for his critique of conspicuous consumption, described how certain luxury goods derive value not from their functionality but from their exclusivity. In the same way, many so-called green energy solutions, such as overpriced solar panels, government-subsidised electric vehicles, and ridiculously inefficient wind farms, are not being adopted because they are the best solutions to energy needs but because they allow their owners to signal virtue.

“Germany’s energy quagmire offers a cautionary tale for the world. While some may be swayed by the siren song of renewable energy and alarmist rhetoric, it’s imperative to ensure energy security and stability. Over-reliance on any single energy source, especially a non-dispatchable, weather-dependent one, in the name of virtue signalling, is a perilous path. As Germany confronts its energy challenges, one can only hope that it serves as a lesson for other nations to prioritize pragmatism over popular but misguided narratives.”

—Charles Rotter 9

Despite vast subsidies and regulatory favouritism, these inefficient renewables often fail to deliver consistent energy output, require backup from fossil fuels, and contribute to higher energy costs. Rather than investing in market-driven innovations that could provide sustainable and cost-effective energy solutions, governments and ESG-driven investors are pushing capital into these prestige projects that do little to address real-world energy demands.

Economic history leaves no doubt: Bucks need to roll freely. Free, or, more precisely, “somewhat free” markets allocate capital efficiently, leading to higher productivity, innovation, and wealth creation. When investors are free to direct their resources toward the most promising opportunities, economies flourish. Nations that understand this principle—like Singapore and Dubai—attract capital and prosper, while those that ignore it—like socialist states—descend into economic ruin.

If history has proven anything, it is that prosperity follows those who embrace free-ish capital markets, while economic misery follows those who resist them. The choice is clear: embrace financial freedom or suffer the consequences of misguided economic policies. At the risk of repeating myself, one can avoid stupidity, but one cannot avoid the consequences of stupidity.

Trivia:

From Allison, Graham, and Robert D. Blackwill (2013) "Lee Kuan Yew - The Grand Master's Insights on China, the United States, and the World," Cambridge, MA: MIT Press, p. 130. Reference to Kwang et al., Lee Kuan Yew: The Man and His Ideas.

From Allison, Graham, and Robert D. Blackwill (2013) "Lee Kuan Yew - The Grand Master's Insights on China, the United States, and the World," Cambridge, MA: MIT Press, p. 116. Reference to Lee Kuan Yew, From Third World to First: The Singapore Story, 1965-2000, New York: HarperCollins, 2000, p. 688.

Rogers, Jim (1994, 2000) “Investment Biker – around the world with Jim Rogers,” Chichester: John Wiley & Sons. First published 1994 by Beeland Interest, Inc., p. 272.

Henry Hazlitt, The Foundations of Morality, 1964.

As quoted in The World's Greatest People, All Things Family, Audio CD, Volume 1, Disk 6.

As quoted in The Cynic's Lexicon: A Dictionary of Amoral Advice (1984) by Jonathon Green, p. 34.

Vivek Ramaswamy, Woke, Inc.: Inside corporate America's social justice scam (New York, NY: Center Street, 2021), chap. 4, Kindle.

Václav Klaus, “Freedom, not climate, is at risk,” Opinion Climate Change, Financial Times, 13 June 2007.

Charles Rotter, Germany’s Energy Crisis: The Perils of Delusional Virtue Signaling, whatsupwiththat.com, 21 September 2023.